The early to mid-stage of a startup’s life is meant to be one of exponential growth. Revenue growth and customer acquisition are the raison d’etre with every strategy aligned with these objectives, without which funding may be impossible to come by. This often takes extreme forms where—since being profitable runs contrary to growth (or so it seems!)—margins are sacrificed at the altar of the Growth God.

While there is logic to the assumption that the more aggressively you price, the more you grow, it's a bit myopic and unidimensional to follow ‘run losses to grow’ or ‘profit is a dirty word’ as a business strategy. The strategy also leads to the bizarre situation, where a startup needs to show high growth rates to raise capital that it needs to burn to show high growth rates to raise capital that…∞

Anyway, let’s look at some specifics—there are two ways to achieve growth while losing money:

- Bargain basement pricing: Slashing prices to poach customers from competition or to get them to try out your disruptive product may be a painful but necessary strategy, depending on the market you operate in and the nature of your product.

- Paying excessively to acquire customers: Beyond product pricing, how much you spend for customer outreach and locking them in determines how much and how fast you grow. This includes all your advertising, marketing, and sales spending.

Pricing low is a short-term strategy used by many businesses, big and small. The second approach is the more popular route to trouble used by startups. Let’s look at two key metrics around both these approaches and how they can be combined to make sure your growth doesn’t bleed you dry—or at the very least, the analysis will tell you how you bled dry!

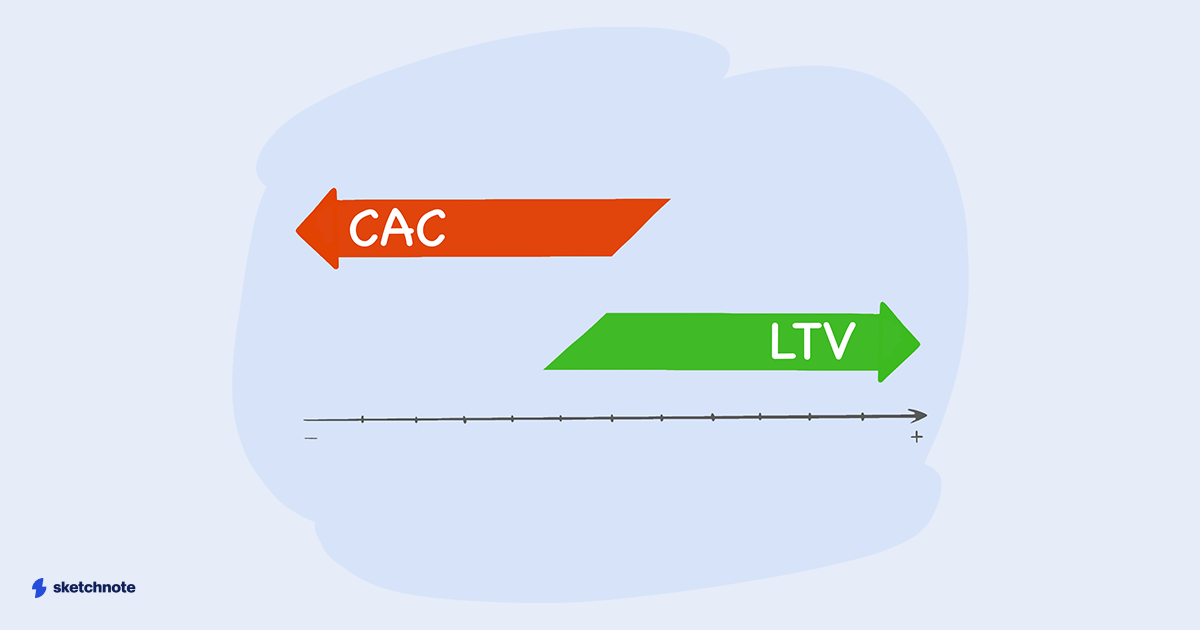

CAC

Customer Acquisition Cost (or CAC) is—or at least ought to be—the most-watched metric by startups and investors, given its potential as a weapon of mass seduction in the pursuit of growth. CAC has been the Waterloo for too many startups that chase revenue growth at any cost.

As the name suggests, CAC is the money you spend to acquire a customer—sales, marketing, advertising, distribution, discounts, freebies, salaries/incentives of sales teams…it’s all here.

At its simplest, add up all these costs, divide this sum by the number of customers acquired, and that’s your CAC. In the early stages, CAC is expected to be high, given that you need to establish yourself as a new entrant or disruptor; moreover, you're figuring out your target segments and entering new markets. Over time, CAC needs to come down, even as ARPU needs to go up.

LTV

Life Time Value (LTV) is the other important indicator of how well your product marketing is doing. Customer LTV is what your average customer is worth to you over the expected average period of the relationship. Needless to say, if you always price low, then you have low customer LTV. To calculate LTV, you need:

- Average revenue

- Average margins

- Average relationship period

- Probability of losing the customer, or ‘Churn’

The LTV formula is:

(Average Monthly Recurring Revenue per customer × Average Gross Margin) / Churn Rate

So, if your average monthly subscription is $1,000, you earn a Gross Margin of 30%, and on average you lose 3% of your subscribers each month, then your LTV is:

($1,000 × 30%) / 3% = $10,000

As with any metric, the important bit isn’t the score but the trend. A low LTV or a high CAC is not a cause of concern in itself, and may even be desirable in the short term. However, it's the trend that matters.

A resolutely low LTV or a high CAC is bad news; a sliding LTV or climbing CAC, even more so. Both warrant deeper root cause analysis and a course correction. The clincher is when you combine these two metrics to figure out how well you are doing. How so?

Say you have a high and growing CAC. That ought to make your blood run cold, right? Not if you have LTV that is climbing at an even higher click, which would mean you’re doing something right in greatly milking the customers you are spending a lot to acquire–the growth goldmine!

LTV/CAC ratio

Thus, when combined into the LTV/CAC ratio, the two go hand-in-hand and provide a metric that shows how well you’re recovering your CAC and serves as your ‘make or break’ predictor. This ratio essentially tells you how much more you’re getting out of your customer, compared to the cost of acquiring them.

If your ratio is, say, 1:3, it means you are in an unenviable and real ‘blood run cold’ position where you spend 3 times what you get in return. You want to be above 1:1, though even that may or may not be enough, depending on how much cash you have on hand, your capex plan, what the imperatives of your existing and potential investors are, etc.

How soon you recover your CAC and how much more value you squeeze out of your customers beyond that will make a massive difference to your medium to long-term cashflow position, which in turn will impact your startup’s valuation materially. Better startups recover their CAC in under 6 months (LTV/CAC > 2x, which means that a year’s CAC is recovered in under 6 months), and definitely within a year (LTV/CAC > 1x).

Bear in mind that apart from the basic factors of pricing and margins (LTV factors) and marketing costs (CAC factors), how long you take to recover CAC will be a function of:

- Your domain,

- Level of competition,

- Channels used for acquiring customers, and

- How long you have been around (in early stages, CAC recovery will be slower, naturally)

A good discipline to develop on this vital metric is to first research benchmarks for your segment. You can use this research to adjust yours according to your stage and then your strategic goals. Finally, learn to record and monitor your LTV/CAC rigorously and consistently. The key is to ensure it's improving, always. Good luck!