For startups that routinely fail, ‘running out of cash’ ranks up there in the list of most common reasons for their downfall. But ‘ran out of cash’ is an outcome, with underlying reasons of its own, not a reason for failure in itself. Fundamental reasons can help you run out of cash or turn your venture into a lemon for VCs:

- Your ice cubes are faulty (product problem);

- You’re trying to sell ice to Eskimos (wrong market fit);

- Your team doesn’t know the first thing about making/selling ice (talent issues);

- You turn to making ice sculptures without understanding what it takes (wrong pivot);

… and so on.

Leaving such strategic reasons aside, here are 5 direct ways to reach the ignominy of running out of cash, even when you’ve got the product sorted, your market correctly segmented, and have more or less the right team:

1. Not focusing on margins

‘Profit’ is almost seen as a dirty word in the startup world. Traction, and then scale, trump all else. Invariably, how much you scale is inversely correlated with how profitably you price your wares. And who will stop you, given that most investors value scale far more than profits, just because the next round’s likely investors value scale far more than profits, and so on? Besides the single-minded focus on scale at the cost of all else, the other mistake startups make is spending too much. The need to have the best of hardware, software, brainware, offices, or branding to show you have arrived burns capital, with nothing much to show for it.

Remedy:

Even if you can’t sight profits, at least keep your eye on your margins, even while they're negative. It's not so much about being profitable all the time but showing progress in shrinking losses and growing margins. This starts with gross margins, followed by operating margins, then EBITDA, EBIT, and so on. Carefully plan targeted breakeven at each profitability level with teams and set hard deadlines. Remember, there are usually less expensive ways of getting things done that get you more bang for the buck on other costs and overheads. Bootstrap, outsource where you can, engage freelancers...think out of the box! Financial budgets (ugh!) are a bitter but necessary antidote for containing spending when everyone involved takes them seriously.

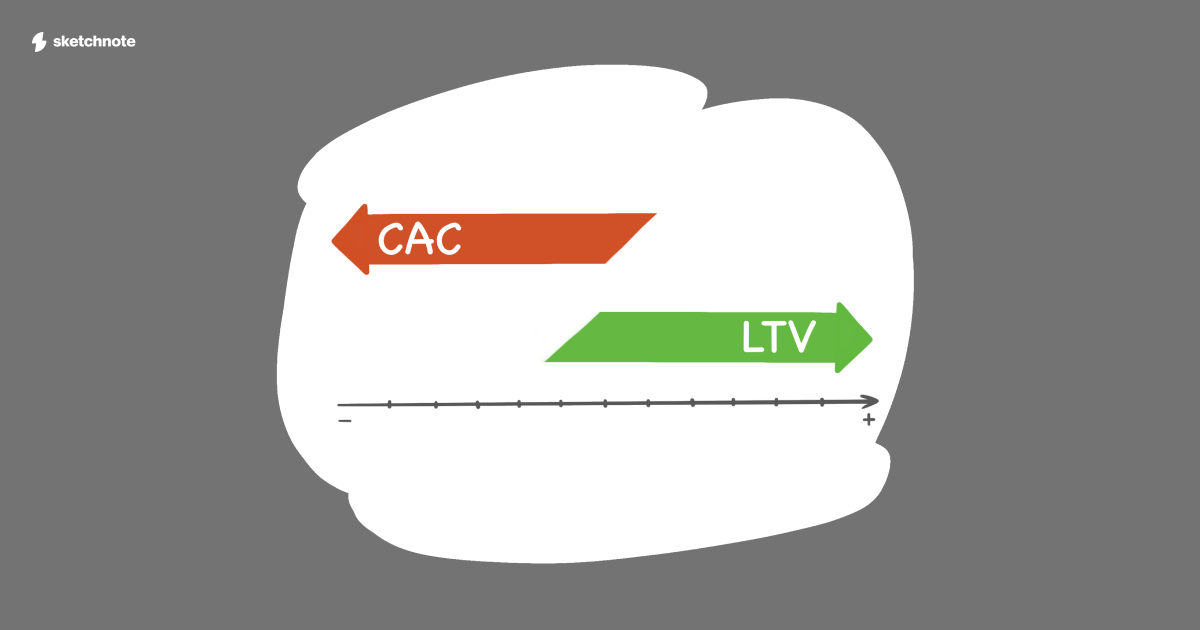

2. LTV/CAC

The LTV/CAC ratio is perhaps the single most important metric you want to track right from the start. The CAC (or customer acquisition cost) is all the cash you spend to acquire a customer. This includes advertising, marketing, discounts, freebies, roadshows, fairs… anything intended to get paying customers. The LTV is the lifetime value of a customer for your startup, which means that the LTV/CAC measures profitability at its core—how much does it cost to get a customer compared to how much is that customer worth to you. You can find more on this important metric in ‘10 Need-to-Know Metrics for Every Startup’.

An out-of-sync LTV/CAC usually lies at the root of most ‘ran out of cash’ situations. There are two scenarios in which this happens:

- The startup has to spend a lot on customer acquisition either because it is new to the segment and needs to challenge incumbents or the product is disruptive; or,

- The product has plateaued on the growth curve. Acquiring new customers gets costlier, and churn is rising.

Remedy:

Between the two, CAC is relatively more controllable than LTV. Build CAC discipline early on; set your thresholds based on your domain’s benchmarks, adjusting for whatever you will need to do as a new entrant and how much capital you have on hand.

3. Wrong priorities

Focusing on the wrong priorities, or the right ones at the wrong time (e.g., building a sales force when product development isn’t sorted) leaks capital. This comes down to basic old-fashioned business management skills that anticipate what sources and uses (especially uses!) of cash are and prioritize well, avoiding the ‘how the heck did that happen?’ facepalm moment when you run out of cash.

Remedy:

The prudence of your bootstrapping days shouldn't be abandoned just because you’ve either managed to raise a round or because the business is generating some small cash surplus regularly. Spend on essentials and save wherever you can. Avoid throwing money at problems like the plague–if a major spending decision comes up, put it to a vote weighing all the pros, cons, and return on the spend. Have your sounding boards in your co-founders, management team, mentors, and anyone you think you can rely on for good judgment. Bad spending decisions usually flow from when you are flying solo and blind.

4. Scheduling your fundraising all wrong

Fundraising is not a function of how hot the market is; it's a function of milestones you set for your startup. The first couple of rounds need to raise enough capital for your product development and marketing to gain traction. Specific milestones matter here; subsequent rounds are about scaling. Milestones matter here, there, and everywhere else. A lack of awareness of these milestones and what cash it will take to get to them is more common in the startup world than one would imagine. Even once you have avoided reasons 1-4 above, you may still trip up by not timing your fundraise well simply because you planned to fail by failing to plan.

Remedy:

Have a tight handle on your Burn Rate (how much net cash you lose each month) and Runway (how long your current cash balance will last) so that you time your fundraising well. An elementary worksheet that plots your Burn Rate and Runway will do for starters. And don’t forget to start your fundraising efforts a few months before the red line–even then, build in a buffer of a couple of months.

5. Perception of team capabilities

Finally, funding doesn’t materialize even after getting everything right because the startup team can’t seem to get traction with investors. This could be reality (individually or collectively, the team isn’t cut out to deliver) or perception (unable to convey or convince investors of either their capabilities or the product’s). Remember that investors continue to focus on co-founders and team leads at EVERY fundraising stage. This is especially true for disruptive and innovative startups where investors have only team quality to bank on in the absence of precedent.

Remedy:

At the onset, figure out what your startup needs in order to be perceived as a viable prospect. Add in any and all necessary skillsets before you approach investors. A bare minimum requirement is a team that balances the crucial aspects of product/tech, sales, and finance. If any investor has turned you down, then get their feedback on your weak points rather than flog the same pitch to more investors. Remember, failure is not stupidity; doing the same thing repeatedly while expecting different results is.

Convention about what is expected from a startup at various stages is overrated at times, especially when it jeopardizes your survival. Nix convention, be disciplined, be organized, and remember the adage ‘revenue is vanity, margin is sanity, and cash is king!’